I get it. You don’t want to pay an annual fee on a credit card.

I used to be the same way. I thought the credit card companies made enough from what I spent and didn’t need an annual fee on top of that, so I avoided any cards with annual fees—until around 10 years ago, when I wised up.

Today, I have over 40 credit cards and many of them have annual fees, totaling in the thousands of dollars each year. And I turn a net profit from every single card. If I calculate that I’m losing money on a card, I close it.

Now, I know I can’t just say annual fees are good and leave it at that, so I’ve laid out some real-world examples for you, involving several different types of cards.

Not all cards with annual fees are right for all people, so you do have to do a bit of math to see what makes sense for you. You’re likely to find that eliminating all annual-fee cards from the get-go isn’t the wise choice.

Airline Credit Cards

Let’s start with an easy one. To be honest, airline credit cards are often a pretty poor value for general spending. You’re better off with a card that earns transferable points like Chase Ultimate Rewards points instead of the basic offerings airline cards come with.

Still, airline cards do have benefits that can offset their $95–$99 annual fees. The main benefit: free checked bags.

Let’s assume you belong to a family of three and you check three bags every time you fly American Airlines, and let’s say you fly four times a year. The first checked bag on American Airlines is $30 per person. So each time you fly, you pay $90—or $360 in a year.

If you had the Citi® / AAdvantage® Platinum Select® World Elite MasterCard or the CitiBusiness® / AAdvantage® Platinum Select® Mastercard®, you and up to four travel companions would get your first bag checked for free on domestic itineraries operated by American Airlines. Each of those cards has a $99 annual fee, waived for the first year.

In the scenario above with the family of three, you would save $261 every year by paying that $99 annual fee when compared with not having the card.

Hotel Credit Cards

Most hotel-branded credit cards offer a free night per year when you pay your annual fee. The cards below all have an annual fee under $100.

- • Marriott Bonvoy Boundless® Credit Card (1 free night up to 35,000 points in value)

- • World of Hyatt Credit Card (1 Category 1–4 free night worth up to 18,000 points)

- • IHG® Rewards Premier Credit Card (1 free night up to 40,000 points in value)

- • IHG® Rewards Premier Business Credit Card (1 free night up to 40,000 points in value)

It’s pretty easy to redeem any of those for a night in a hotel charging $200+ for a room, thus returning double the roughly $100 annual fee you paid.

On top of that, you get all the other benefits and perks that each card has.

For example, the Hyatt card comes with 5 elite nights annually toward status; the Bonvoy Boundless card comes with 15 elite nights and Silver Bonvoy Elite Status; and the IHG cards both allow you to get 4 reward nights for the price of 3.

If you aren’t familiar with hotel loyalty programs, you get additional perks as you stay more and more nights, achieving various status tiers. You can work your way up to higher status levels, which can come with benefits like free breakfast, late checkout, and room upgrades as you move up the status ladder.

Each loyalty program has its own requirements to achieve each tier level, and the benefits vary for each program. To get an idea of what you can get, you can explore the World of Hyatt status tiers here and Marriott status tiers here.

I’m not suggesting putting your daily spending on these hotel-branded cards, as that should go on a bank card that earns transferable points to get the most bang for your buck. But you can see the value that these annual fees pay back.

Transferable Bank Point Cards with Low Annual Fees

Two cards with $95 annual fees immediately come to mind that are absolutely worthwhile: the Chase Sapphire Preferred and the Citi Premier. The American Express Gold Card, with a $250 annual fee, can also be worth getting.

Let’s consider each card in turn.

Chase Sapphire Preferred® Card

I have long considered the Chase Sapphire Preferred the best credit card for someone getting started in miles and points. Its $95 annual fee allows you to redeem your points for travel in the Chase travel portal at 1.25 cents per point or, better yet, transfer the Ultimate Rewards points you earn to airline and hotel partners like United and World of Hyatt, and you could get more than 2 cents per point in value.

The card comes with a hefty bonus offer, giving you a large number of points right off the bat so you can start learning the best ways to redeem Chase Ultimate Rewards points.

Not only that, but the card also comes with one of my favorite features: Primary Car Rental CDW (Collision Damage Waiver) coverage. That means that if you use your card and decline the CDW from the rental company, you are fully covered for accidental damage to your rental. And since it’s primary coverage (unlike with most credit cards), your personal insurance won’t need to be involved at all.

On top of that, the card comes with trip delay insurance, covering you for expenses you might incur when your flight is delayed for more than 6 hours. Crucially, that includes the expense of an overnight hotel stay.

What’s more, you’ll earn 3X Ultimate Rewards points on dining and streaming services, 5X on Lyft rides through March 2025, 3X points on online grocery purchases, 5X points on travel booked through the Chase travel portal and 2X on all travel booked directly with a provider. All other eligible charges earn 1X point per dollar spent.

Citi Premier

The often overlooked Citi Premier card has a slew of amazing 3X bonus categories. It earns 3X Citi ThankYou Points in air travel, hotels, gas stations, restaurants (including takeout and delivery), and supermarkets.

I can’t think of another card that has so many commonly used bonus categories with just a $95 annual fee.

While Citi’s ThankYou program doesn’t partner with any U.S. airlines directly, the program does include airlines in every alliance, so you can book tickets on almost any carrier.

To explain: Airlines have alliances and partnerships that enable you to redeem one airline’s miles for travel with another airline, and these are often the best values.

For example, with Citi ThankYou, you could book a flight with Delta Air Lines using Virgin Atlantic Flying Club points or Air France Flying Blue points (depending on availability). Both are transferable from Citi ThankYou.

ThankYou points can also transfer to Choice Hotels, where you can—and this is kind of a secret—book select properties in the Preferred Hotels & Resorts chain at bargain rates using points.

American Express® Gold Card

While Amex does have a sub-$100 annual-fee card on the market (the Green Card), we find that the Amex Gold Card, which also comes in a fun Rose Gold color, is a better deal despite its $250 annual fee.

That’s because you get two monthly perks that, taken together, add up to $240 in savings, effectively leaving just $10 as the net annual fee.

Those two perks?

• You’ll receive up to $10 in monthly dining statement credits when you make purchases with Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar, and select Shake Shack locations. (Enrollment required.) You will get a statement credit after making the purchase.

• You’ll also receive $10 in Uber Cash on the first of each month if your Gold Card has been added to your Uber account.

With the annual fee nearly taken care of, you’ll earn 4x American Express Membership Rewards points at restaurants (including U.S. takeout and delivery) as well as at U.S. supermarkets (up to $25,000 a year; 1X thereafter on eligible purchases), plus 3x on flights.

Overall, the Amex Gold Card has a great set of bonus categories—especially for supermarket spending.

High-End Annual Fee Cards

If you have a bit more disposable income, the following cards come with all kinds of perks and statement credits—but they only make sense, budget-wise, if you will use them. This is where you’ll need to do some math.

I’ll consider two examples of high-end cards, but the math on any of them is the same: Figure out which perks you’ll use, subtract the annual fee, and see if it’s a deal for you.

Marriott Bonvoy Brilliant® American Express® Card

The Marriott Bonvoy Brilliant® American Express® Card is a hotel credit card that may or may not provide value in spite of its huge $650 annual fee.

Without going into all the card’s benefits, three features will likely determine whether this is a fit for you:

- • Platinum Marriott Bonvoy Status

- • 1 free night, valued up to 85,000 Marriott Bonvoy Points, each year you renew the card

- • 25 elite night credits toward status

For some travelers, Platinum status with Marriott Bonvoy alone may make the card worthwhile. The Platinum level confers room upgrades up to standard suites (your prospects for substantial upgrades are much higher outside the United States), and, perhaps more important, entitles you to breakfast at most of Marriott’s mid- to high-end brands like Marriott, JW Marriott, and St. Regis, and/or access to the Executive Lounge, when available.

The 25 elite night credits are useful if you are gunning for an even higher status than Platinum or if you want any of the Choice Benefits that you receive at 50 elite nights each year, such as 5 Suite Night upgrade awards, which can confirm upgrades up to 5 days in advance of your stay.

To clarify the term “elite night credits,” they refer to those nights we discussed earlier that add up to the various elite status tiers.

As an example, if you want Marriott Titanium status, you can stay 75 nights in Marriott-affiliated hotels. But the Bonvoy Brilliant card gifts you 25 nights, so you would only need 50 more nights to earn that status. (Pro tip: You are allowed to have both the Bonvoy Brilliant and the Marriott Bonvoy Business® American Express® Card, which gifts you 15 more elite nights each year, starting you off with 40 elite nights before you even step foot in a Marriott!)

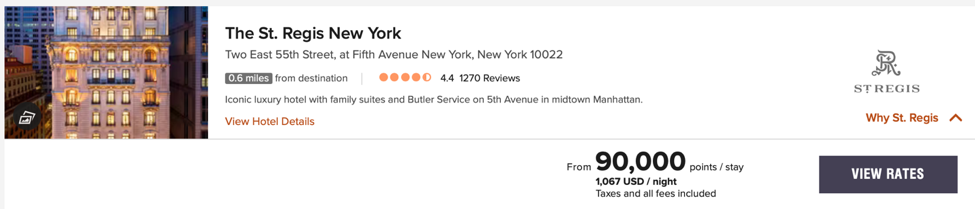

Finally, the free night of up to 85,000 points in value (which you can bump up to as much as 100,000 points using up to 15,000 points from your Bonvoy account) is worth at least $400—or maybe more, depending on where you use it. On a quick search for hotels in New York City, I found that I could take that free-night certificate (worth 85,000 points), top it up with just 5,000 Bonvoy points, and stay in a room at the St. Regis selling for over $1,000 a night.

Do you value those perks enough to merit the card’s steep annual fee? I’ll leave that to your own cost-benefit analysis.

The Platinum Card® from American Express

This card comes with an eye-popping $695 annual fee, but it also comes with a massive amount of perks and statement credits that may make it a worthwhile card for you.

Note that the card has only one bonus category for spending—5X points on airfare. (You can also earn 5X on prepaid hotels, but only via AmexTravel.com.) Beyond that, this is more of a perks card than a card to put everyday spending on.

One important benefit is the range of airport lounges you’ll have access to:

- • Centurion Lounge airport lounge access. These lounges are only accessible by American Express Platinum and Centurion (Black Card) holders as well as holders of the Delta SkyMiles® Reserve and Delta Reserve Business Card.

- • Priority Pass airport lounge access, including two guests at no extra charge (excludes Priority Pass restaurants; enrollment required)

- • Delta SkyClub access when you are flying Delta (no guests)

- • Plaza Premium lounge access (you can bring two guests for free)

The American Express Platinum card also comes with elite hotel status. You’ll get both Hilton Honors Gold and Marriott Bonvoy Gold status. With Hilton, that entitles you to a daily food-and-beverage credit as well as room upgrades. (Enrollment is required for both statuses.)

Additionally, you’ll be reimbursed (as a statement credit) for your Global Entry or TSA PreCheck membership fees every 4 years.

Plus, the card comes with all these statement credit opportunities:

- • $200 in Uber credits annually ($15 per month with a $20 bonus in December)

- • Up to $100 in annual Saks Fifth Avenue shopping credits per year ($50 January–June and $50 July–December) as statement credits

- • Up to $200 in annual airline fee credits (as statement credits) for one chosen airline

- • Up to $240 in a Digital Entertainment Credit good for up to $20 back each month on select digital subscriptions with Audible, Disney+, The Disney Bundle, ESPN+, Hulu, Peacock, SiriusXM, and The New York Times

- • $200 Hotel Credit as statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with a 2-night minimum stay with American Express Travel

- • $189 CLEAR® Credit as statement credits when you pay for your CLEAR® membership with your card

- • Up to a $300 Equinox Credit: Receive up to $300 back per calendar year in statement credits for purchases at Equinox (valid for Equinox All Access, Destination, or E by Equinox membership fees, or for Equinox+).

- • $300 statement credit when you purchase a SoulCycle At-Home Bike, up to 15x per calendar year. An Equinox+ membership is required to purchase a SoulCycle at-home bike and access SoulCycle content. You must charge the full price of the bike in one transaction. Shipping available in the contiguous U.S. only.

- • Up to a $155 Walmart+ Credit: The cost of a $12.95 monthly Walmart+ membership is covered with a statement credit after you pay for Walmart+ each month with your Platinum Card. Cost includes $12.95 plus applicable local sales tax. (Plus Ups are excluded.)

Note: All above offers require enrollment after you receive the card. Terms apply.

As you can see, if you used all of those statement credits, you’d get $1,884 in total credits for your $695 annual fee.

That clearly demonstrates how you can get double or triple your annual fee in value from card benefits. However, you should be realistic about which offers you will actually take advantage of. If you don’t use Uber or Uber Eats, if you don’t subscribe to any of the digital entertainment options, if you don’t use Equinox, if you don’t shop at Walmart, and so on, your net value gets reduced by quite a bit.

Still, many customers get far more than $695 in value out of the The Platinum Card® from American Express.

That’s what I mean when I say you have to do the math!

Cards Mentioned in This Article:

• Citi® / AAdvantage® Platinum Select® World Elite MasterCard

• CitiBusiness® / AAdvantage® Platinum Select® Mastercard®

• IHG® Rewards Premier Credit Card

• IHG® Rewards Premier Business Credit Card

• Marriott Bonvoy Brilliant® American Express® Card